Posts in category Mortgage Loans

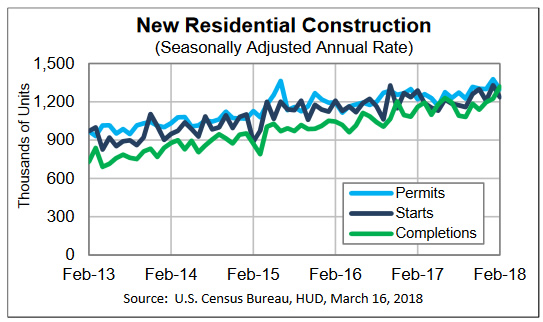

6 reasons why new construction is on ...

New construction is up in New England and nationwide. Here are some reasons why: 1. The improved economy has driven more builders to re-enter the home building market. 2. There is now a shortage of existing homes for sale in most price ranges. 3. Bidding wars often occur on existing properties but new construction may free buyers from this uncertainty and give them more […]

When can I refinance my mortgage loan...

Many homebuyers go into their purchase thinking they can refinance into a lower rate in the future. Although this may be true, it’s not something that one should consider as a factor when deciding to buy a home. Who knows what rates will be or what qualifying guideline may prevent a refinance from being a […]

What happens after I sign the sales a...

Congratulations! You found the house you want to buy. You’ve negotiated a sales agreement – you have a signed offer. What next? You need to give the sales agreement to your lender. Your lender will create a property-specific loan application and forward the application and disclosures for you to sign. Once you have signed these […]

Top 4 Reasons People Refinance

When does my mortgage insurance go aw...

When/how to remove private mortgage insurance (PMI) from a loan… To remove private mortgage insurance (PMI) that you pay on your mortgage loan, you must be up to date with your monthly payments. These rules apply to mortgages closed on or after July 29, 1999. Federal law generally provides two ways for you to remove PMI […]