Who Qualifies for a VA loan?

- Veterans with a certificate of eligibility

- A veteran’s spouse may be a co-applicant on a VA loan if the Veteran is also on the loan

- A veteran cannot have a non-veteran as a co-applicant unless the co-applicant is the Veteran’s spouse

- Not limited to first time home buyers

- VA loan may be used more than once but some restrictions do apply

- If you’re not sure if you’re eligible or if you need a certificate of eligibility, we have the authority to go online to the VA website and retrieve this for you, simply contact us to see how we can help.

Qualifying Details

- Max loan amount for a VA loan is $2,000,000

- No down payment is required for VA loans

- The seller can pay closing costs and prepaid expenses associated with a purchase but this needs to be negotiated into the contract and should be discussed with your loan officer to determine the limitations

- Minimum of 580 credit score required by Bookend Lending

- Available for 1- 4 unit properties and VA approved condos

- can be combined with NH Housing and down payment assistance

- No income limits apply so it is less restrictive than other loan programs that have income limits

- VA loans go through automated underwriting but manual underwriting is also permitted

- Residual income is taken into consideration. Residual income is the amount of net income remaining after deduction of debts and obligations and monthly shelter expenses. The remaining residual after these deductions must be sufficent to cover family living expenses such as food, health care, clothing and gasoline. The numbers are based on data supplied in the Consumer Expenditures Survey (CES) published by the Department of Labor’s Bureau of Labor Statistics. They vary according to loan size, family size and the region of the country.

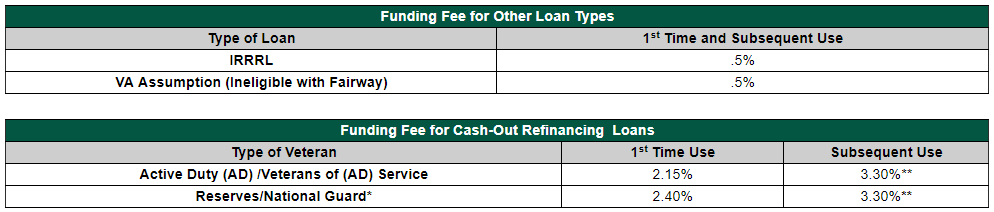

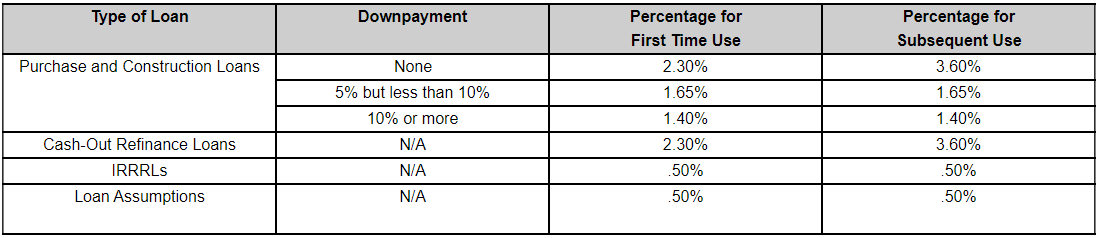

VA Funding Fee depending upon whether the loan is a purchase, cash-out refinance or an IRRRL*

*IRRL = interest rate reduction loan (type of refinance)

*IRRL = interest rate reduction loan (type of refinance)

How to Determine the Funding Fee

- The certificate of eligibility is crucial in determining the VA funding fee

- The funding fee varies depending on whether veteran is obtaining his or her first VA loan or is a subsequent user of VA home loan. An entitlement code of “5” on the certificate of eligibility indicates subsequent use, as does a loan number entered in the “Loan Number” column.

- Determine the amount of down payment made by the veteran and calculate what percentage of the sales price it equates to.

The following persons are exempt from paying the funding fee:

- Veterans receiving VA compensation for service-connected disabilities.

- Veterans who would be entitled to receive compensation for service connected disabilities if they did not receive retirement pay.

- Veterans who are rated by VA as eligible to receive compensation as a result of pre-discharge disability examination and rating or on the basis of a pre-discharge review of existing medical evidence that results in issuance of a memorandum rating.

- Veterans entitled to receive compensation, but who are not presently in receipt because they are on active duty.

- Surviving spouses of veterans who died in service or from service connected disabilities (whether or not such surviving spouses are veterans with their own entitlement and whether or not they are using their own entitlement on the loan).