Why does my lender require a tax transcript?

If your lender is requiring a tax transcript, don’t worry. It’s just a normal part of the process. In an effort to reduce fraud and to enforce the Patriots Act which includes identifying terrorists and drug traffickers, most loan programs require the lender to get a tax transcript which can be ordered via the 4506t. Click this link for a printable 4506t

Tax Returns vs W2s

- W2s are commonly required on every loan type and typically all W2s for the past 2 years are required

- 1099s should be reported on the Schedule C or business return therefore they are not typically required

- Personal tax returns are 1040’s and may include schedules

- Business tax returns can be found in several variations

- Schedule C to the 1040 (filed for sole proprietors or people with 1099 income)

- Corporate returns (Form 1120)

- Partnership returns (Form 1065)

When are tax returns required?

Generally tax returns are required when one or more apply:

- the borrower is self employed

- the borrower received 1099 income

- the borrower filed a Schedule C or E

- the borrower receives substantial overtime

- the borrower is paid by commission

- the borrower receives substantial bonus income

- the borrower receives automobile reimbursement that may be considered as income

- the borrower has rental income

- the borrower has royal income

- the borrower is using a first time buyer program

- the borrower is applying for a tax credit

- if it’s early in the year and a tax refund will be the source of down payment then the tax return may be requested by the lender

- other as may be determined by the lender

What if I cannot find find my tax returns?

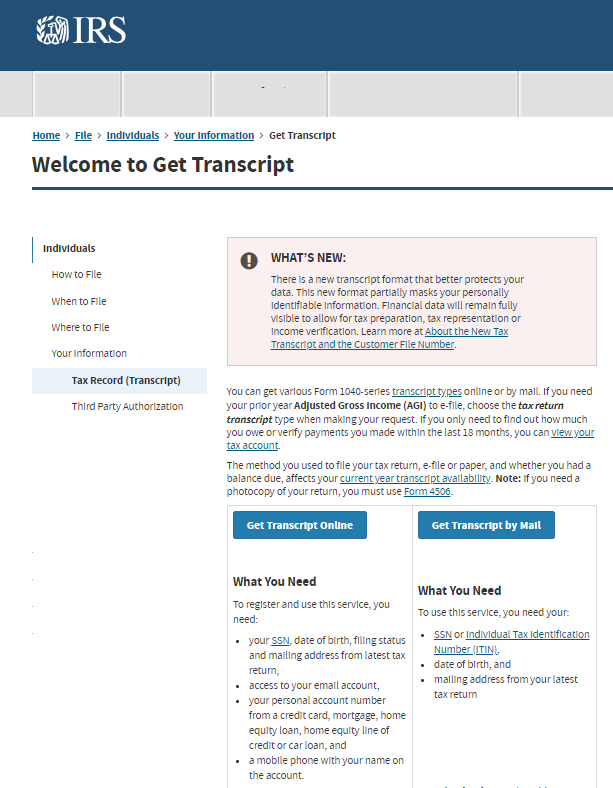

You can obtain your tax returns or your tax return transcripts directly from the IRS. In some cases they may be available online